estate tax return due date 1041

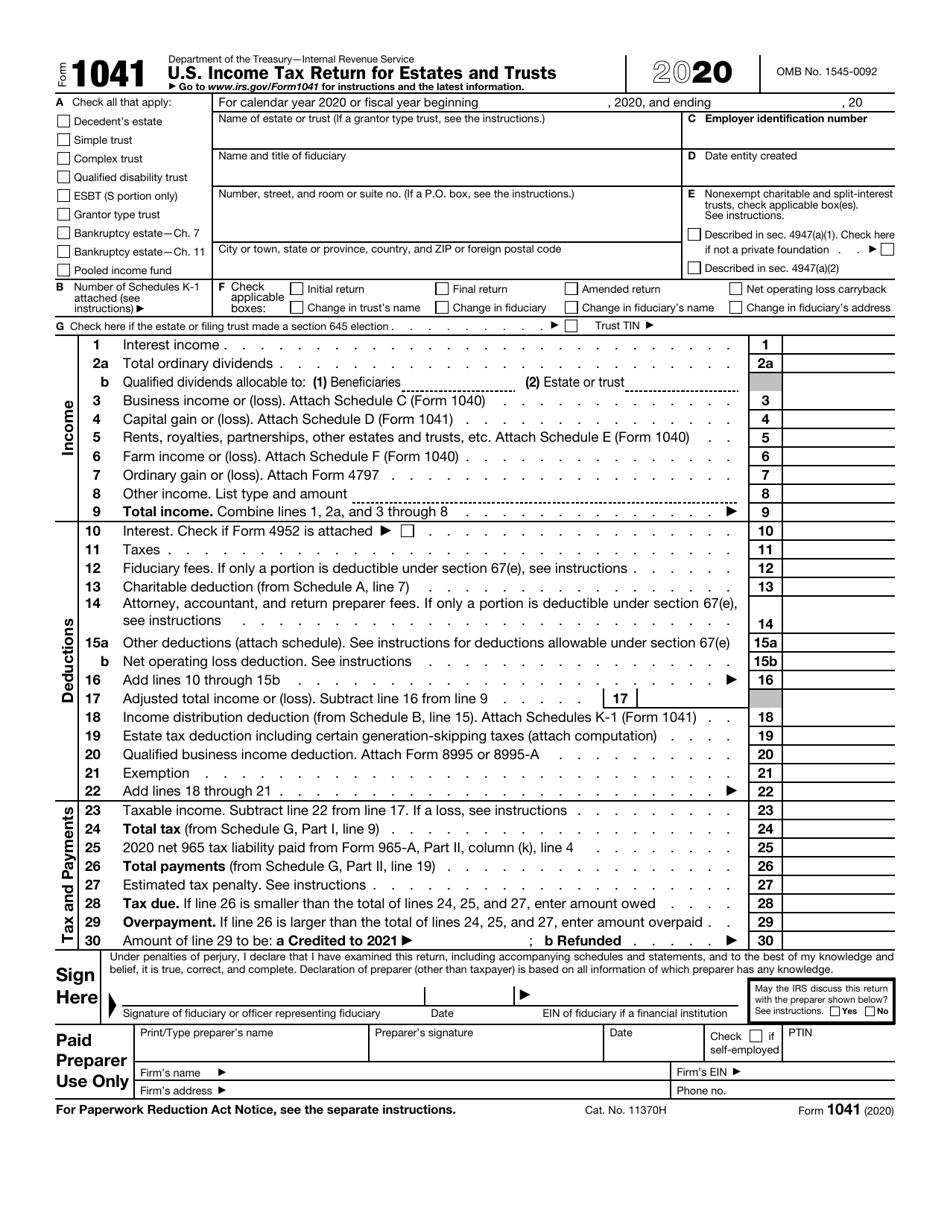

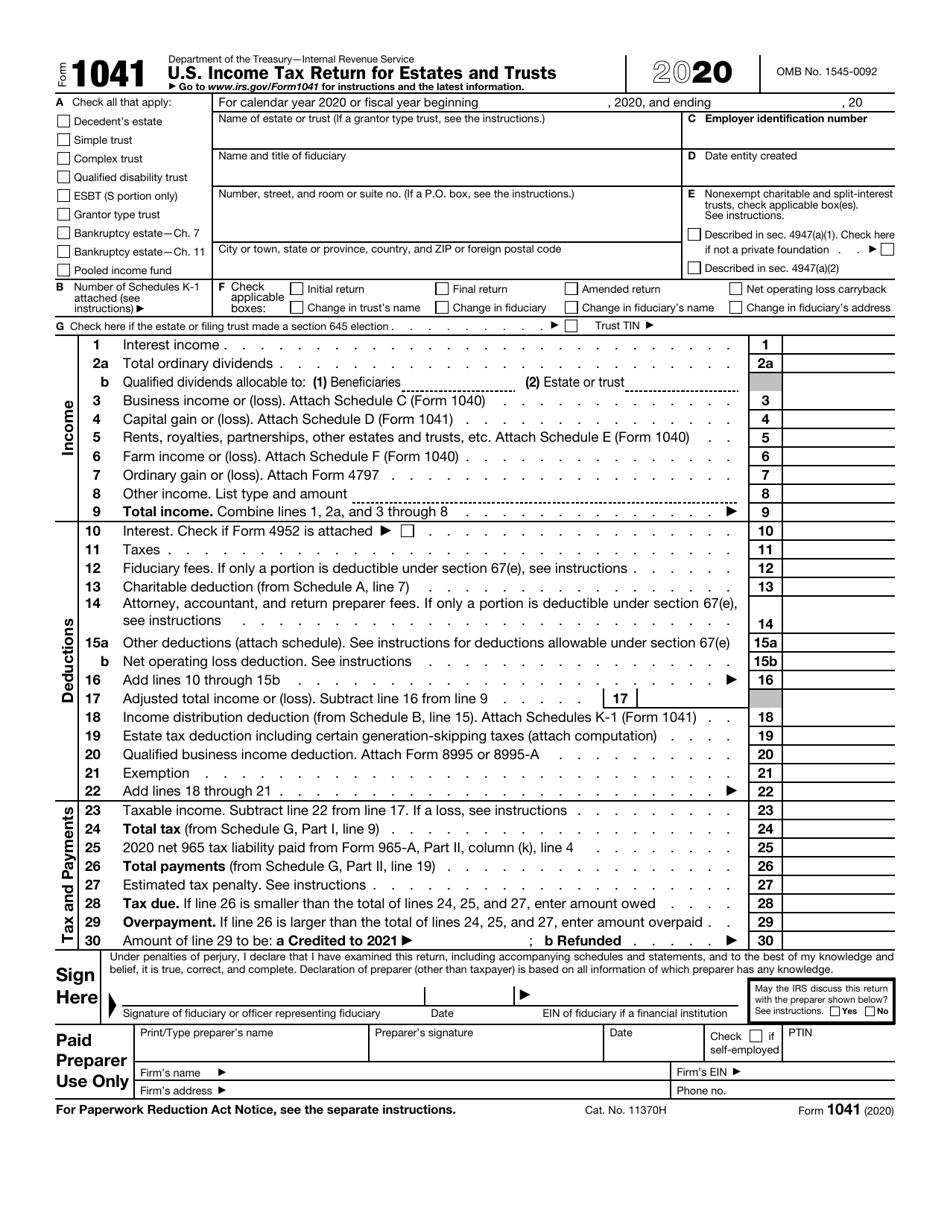

IRS Form 1041 US. An estates tax ID number is called an employer identification.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

I dont see anywhere to enter bank info etc.

. 1 2 885 Reply. The due date of the decedents federal estate tax return or April 15th following the year of decedents death. About Form 8822-B Change of Address or Responsible Party - Business.

3 However not every estate needs to file Form 706. Federal gift tax returns are ordinarily due on the earliest of the following dates. If you live in Maine or Massachusetts you have until April 19 2022.

It depends on the value of the estate. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020. When is Form 1041 Due.

The return is due 3 months and 15 days after the last day of the fiscal year. Refer to IRS Form 706. The return is due April 15 2019.

Since this date falls on a holiday this year the deadline for filing Form 1041 is Monday April 18 2022. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post. If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to request an extension.

TT Business filled in the 1041 estate beginning date to be the death date in April 2020 and the end date to be Dec 31 2020. Whereas an estate tax return is a one-time transfer tax on the value of the assets owned by a decedent at their death and are due nine. These additional forms returns apply to certain.

31 of the same year. What is the due date for IRS Form 1041. For fiscal year estates and trusts file Form 1041 and Schedules K-1 by the 15th day of the 4th month following the close of the tax year.

You are essentially correct cap gains usually excluded but can definitely be included under certain circumstances consistent with law and the trust doc and that term DNI is defined in the. Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021. In this case the estate income.

About Form 1041-T Allocation of Estimated Tax Payments to Beneficiaries. If you choose a fiscal year file a Form 1041 that covers the period May 2 2018 - April 30 2019. Typically the estate calendar year starts on the day of the estate owners death and ends on Dec.

Differences in preparing Form 1040 and Form 1041. What is the Deadline to file Form 1041. An estate income tax return is an annual filing which taxes the income generated by the estate in the taxable year.

Can the estate pay the tax if the income has not been distributed avoiding K-1 to beneficiaries. The IRS has electronic payment options for Form 1041 returns but does not allow direct deposit of refunds. There are notable exceptions to this.

There is an important distinction regarding the timeline of filing Form 1041. Income Tax Return for Electing Alaska Native Settlement Trusts. More Help With Filing a Form 1041 for an Estate.

If the due date falls on a Saturday Sunday or legal holiday file on the next business day. This is correct but we did not need to file an estate tax return in 2020 I propose to input all info as 2021 data manually change these two dates on the form 1041 after printing it out. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia.

Form 1041 for simple estate says taxes are due. About Form 1041-N US. For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041.

The upcoming April 15 2021 income tax deadline doesnt only apply to businesses. File Estate 1041 form with a refund due. If Form 1041 does not cover calendar year you may not be able to do this Many items that are deductible on Form 1040 can be deducted on Form 1041.

13 rows Only about one in twelve estate income tax returns are due on April 15. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia. Form 1041-A is a calendar year return which is due by April 15th.

For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year. For calendar-year file on or before April 15 Form 1041 US. Many charitable trusts and recipients of trusts and estates are required to file Form 1041 by this due date.

For trusts operating on a calendar year this is April 15 2022. The decedent and their estate are separate taxable entities. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

For help in determining when tax returns are due for a deceased individual in a particular year read the IRS Instructions for Form 1041 and Schedules A B G J and K-1. Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. Additionally it is due on the same date as your individual income tax return Form 1040.

The due date of the decedents federal estate tax return or April 15th following the year of decedents death. Calendar year estates and trusts must file Form 1041 by April 18 2022. For example an estate that has a tax year that ends on June 30 2021 must file Form 1041 by October 15 2021.

How does an estate receive its tax refund after filing Form 1041. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

For calendar year estates and trusts file Form 1041 and IRS Schedule K-1 on or before tax day. BTW a Trust and Estate Income Tax Return is often called a Fiduciary Income Tax Return. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. So if the fiscal year closes on June 30 you have until October 15 to file a return. The estate tax year is not always the same as the traditional calendar tax year.

The calendar year for an estate runs from the date of the decedents death through the end of the year December 31. When is the due date for Form 1041. Due date of return.

Trusts and estates are required to file this form with the IRS four months and 15 days after the close of the tax year. If youre using the fiscal year for tax returns the IRS will require you to file Form 1041 by the 15th day of the fourth month after the fiscal year closes.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Irs Form 1041 Download Fillable Pdf Or Fill Online U S Income Tax Return For Estates And Trusts 2020 Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Income Tax Return When Is It Due

U S Income Tax Return For Estates And Trusts Form 1041

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Checklist For Use By Executor Checklist Printable Checklist Printable Chart

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

When To File Form 1041 H R Block

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Form It 141 Download Printable Pdf Or Fill Online West Virginia Fiduciary Income Tax Return For Resident And Non Resident Estates And Trusts 2017 West Virginia Templateroller

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

10411204 Form 1041 U S Income Tax Return For Estates And Trusts Page 1 2 Nelcosolutions Com

Irs Form 1041 Estates And Trusts That Must File Werner Law Firm